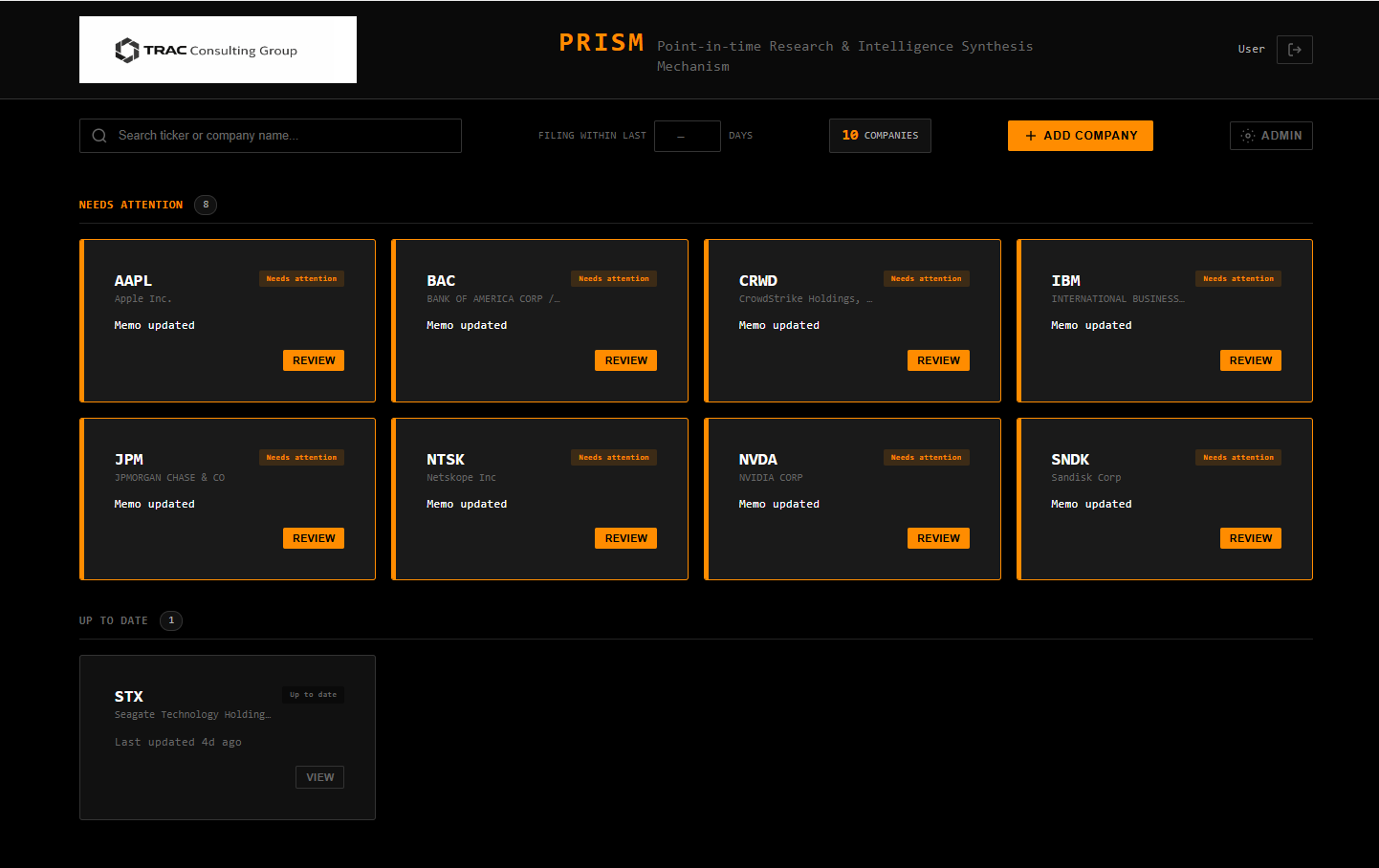

See PRISM in Action

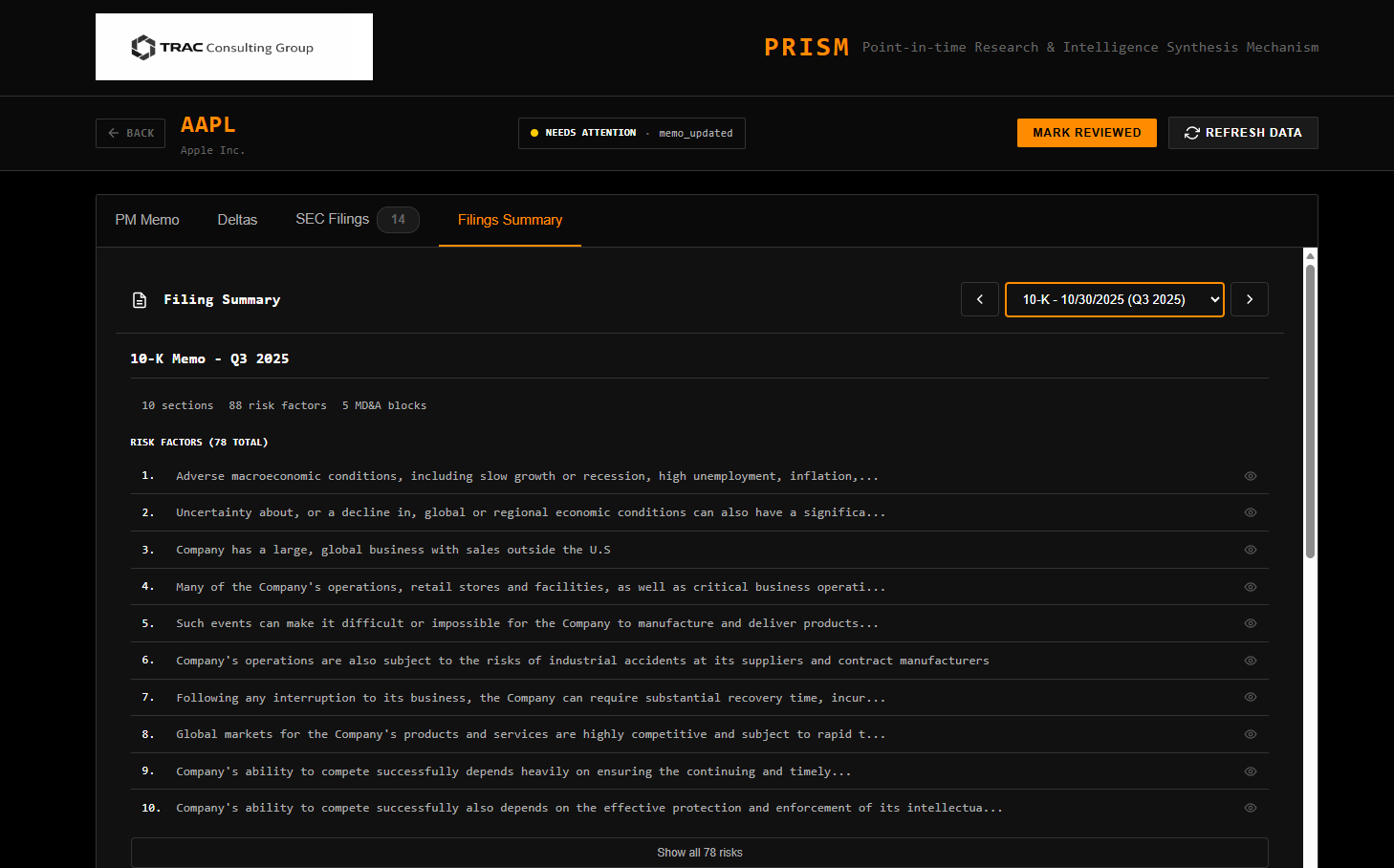

A clean interface designed for analyst workflows.

Company coverage dashboard with attention flags

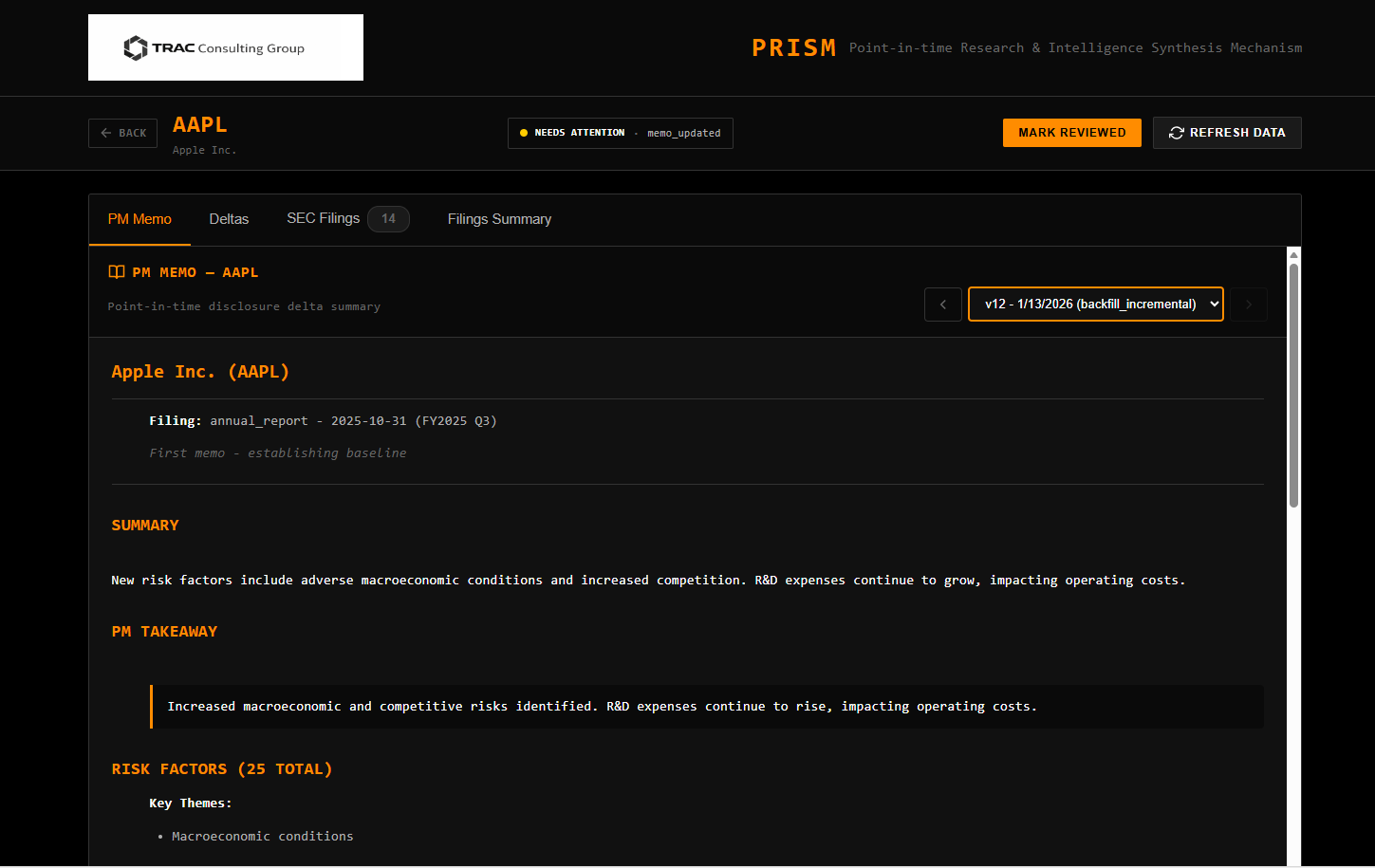

PM memo with summary, takeaway, and key themes

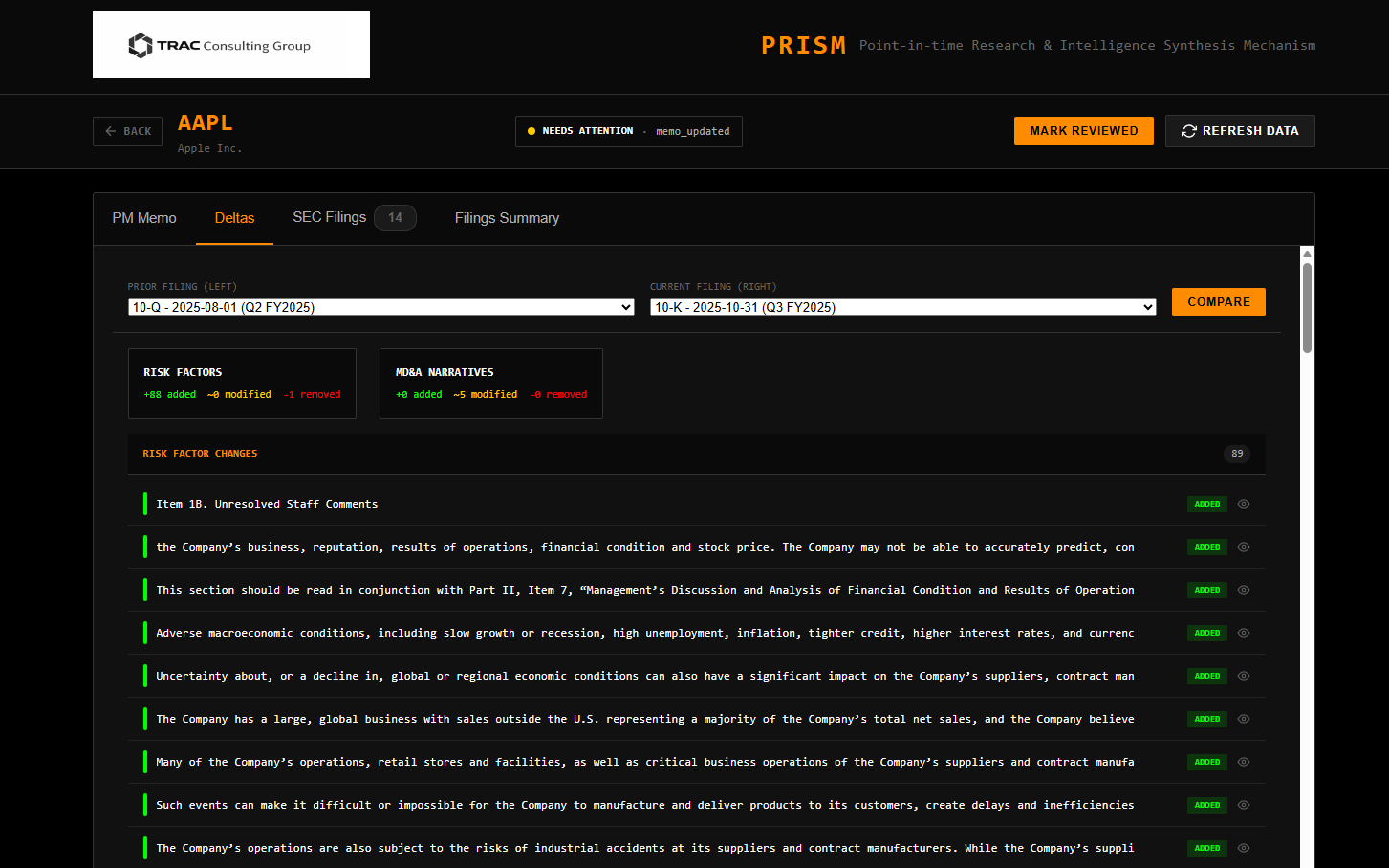

Risk factor changes between filings

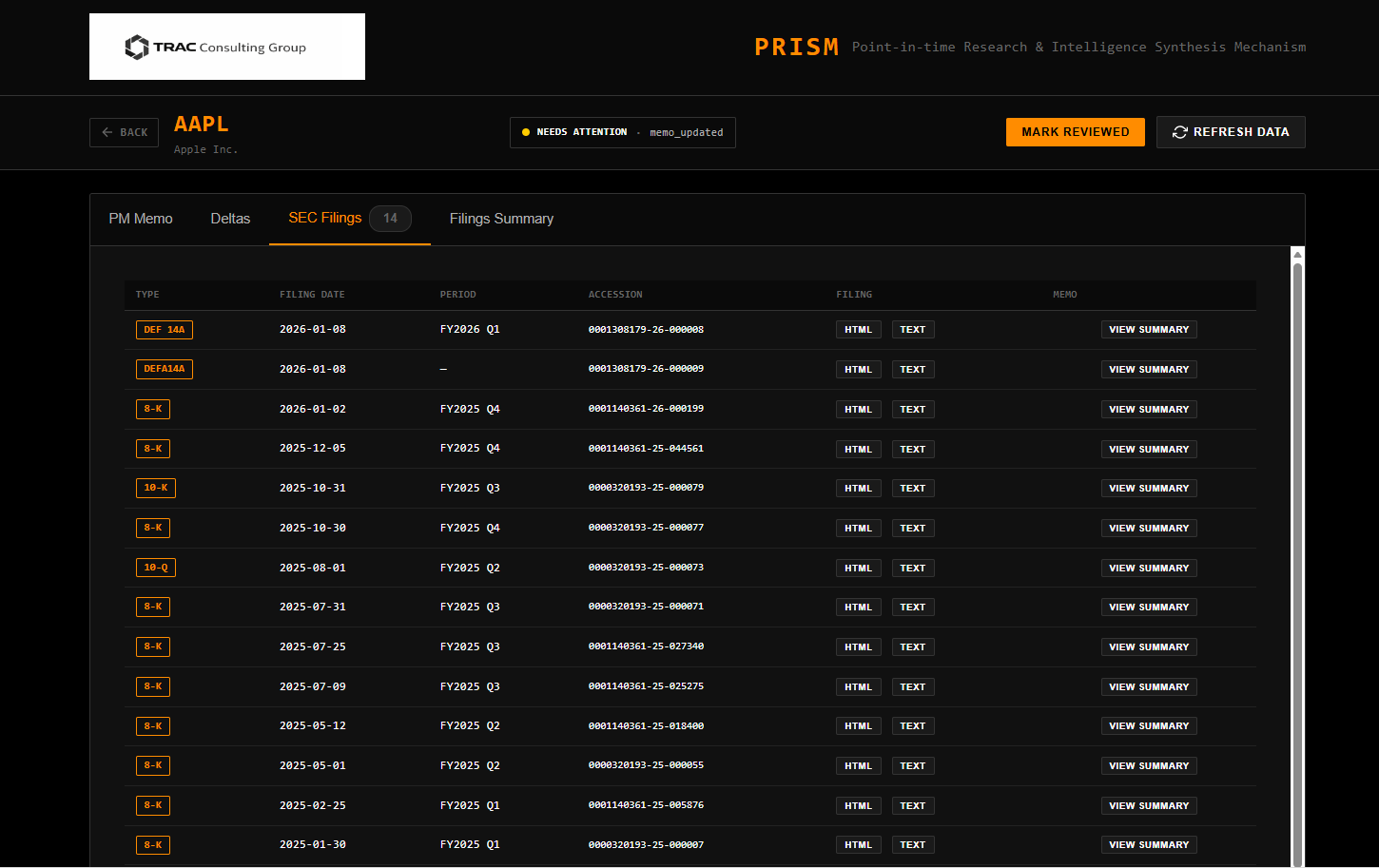

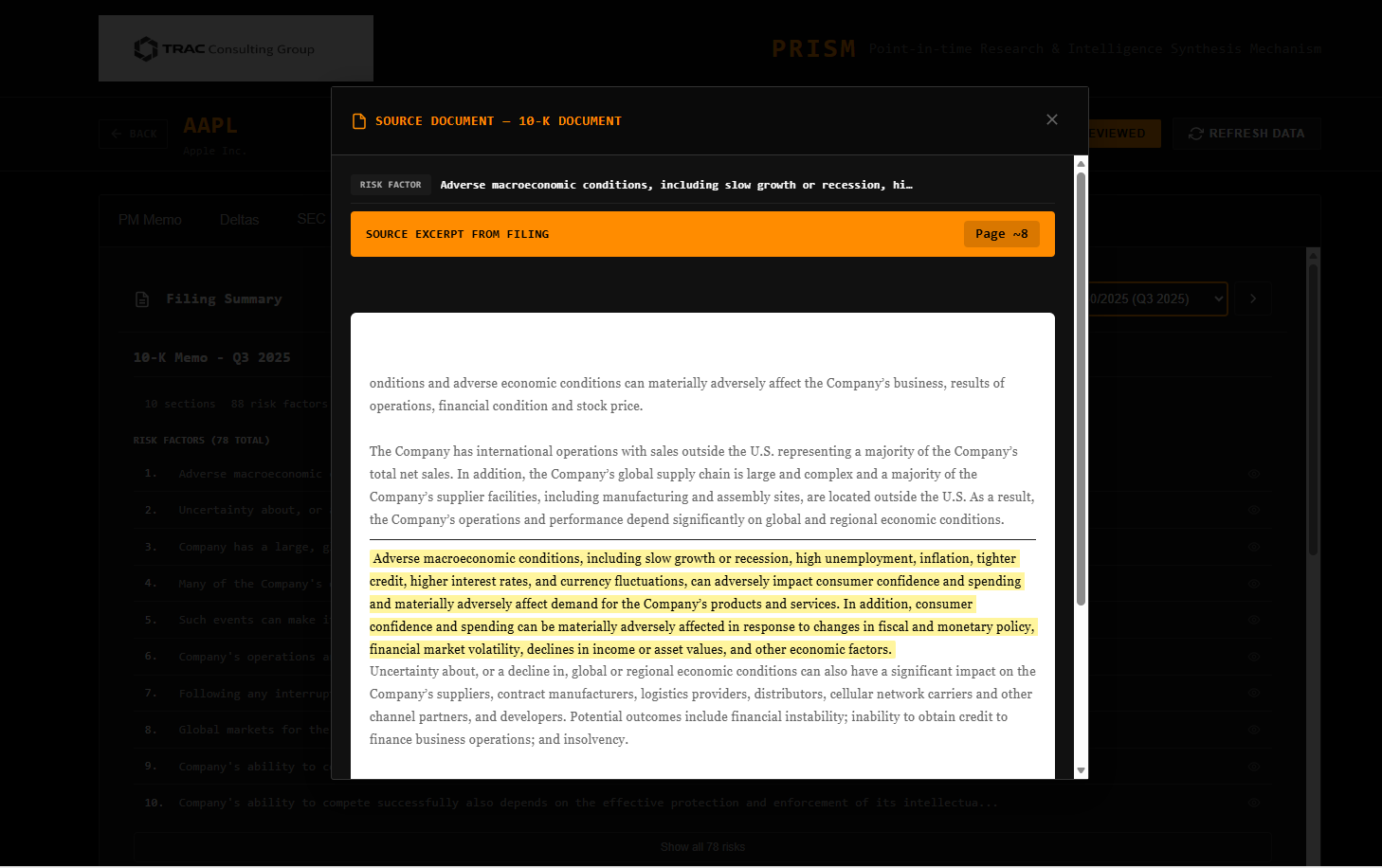

SEC filings with direct links to source

Extracted risk factors from 10-K filings

Click-through to highlighted source text